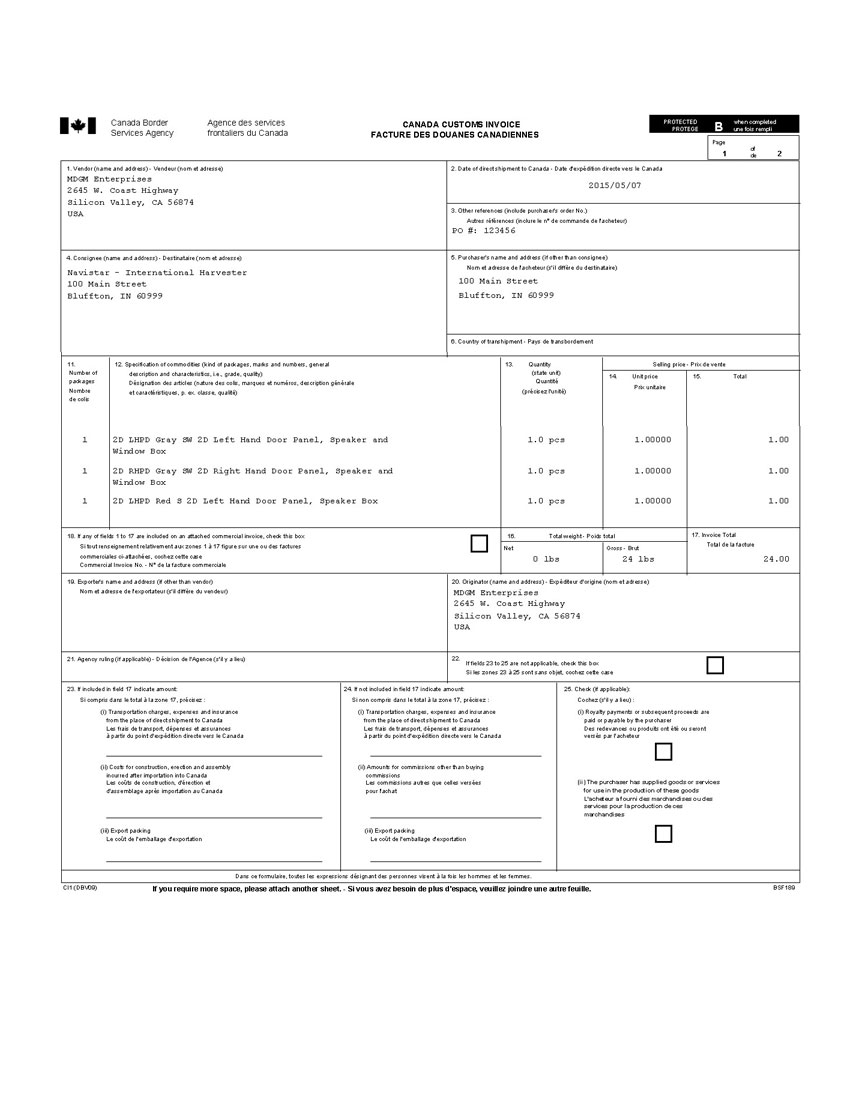

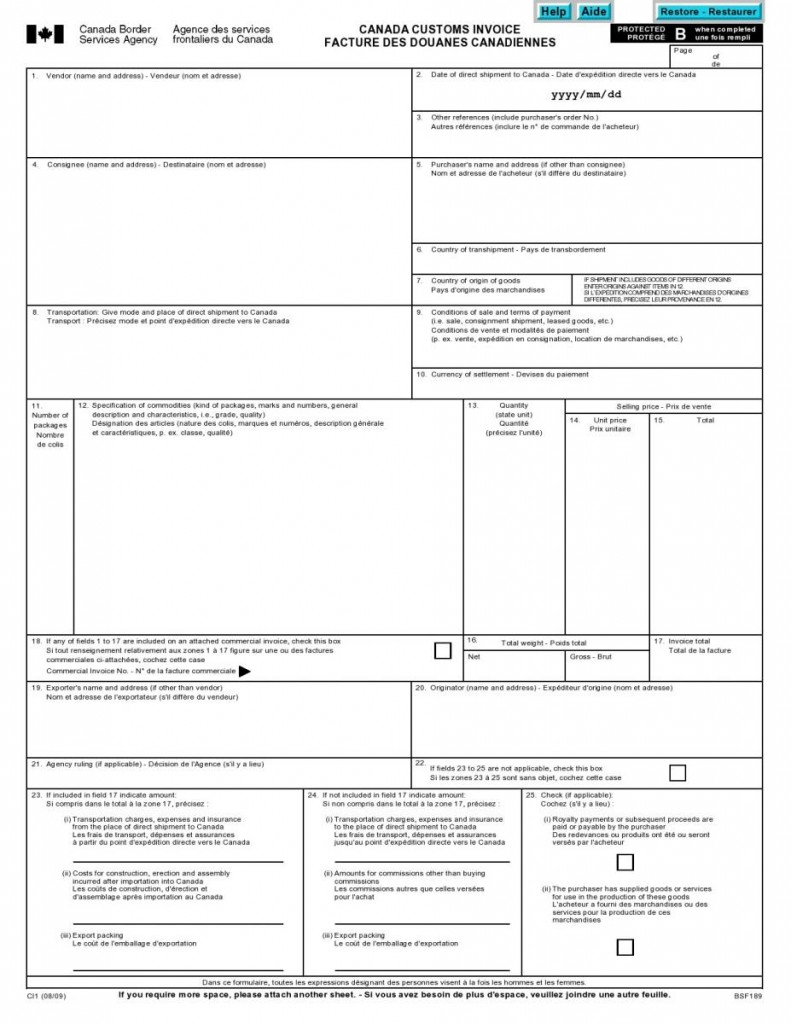

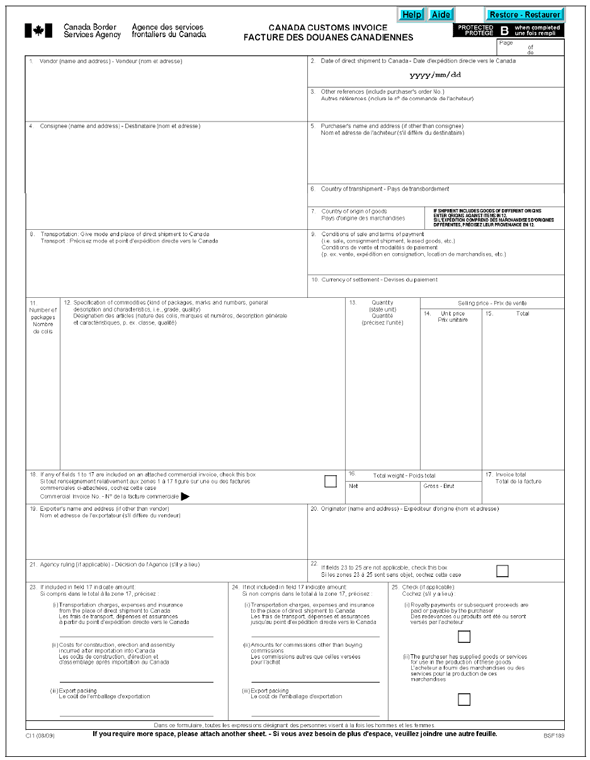

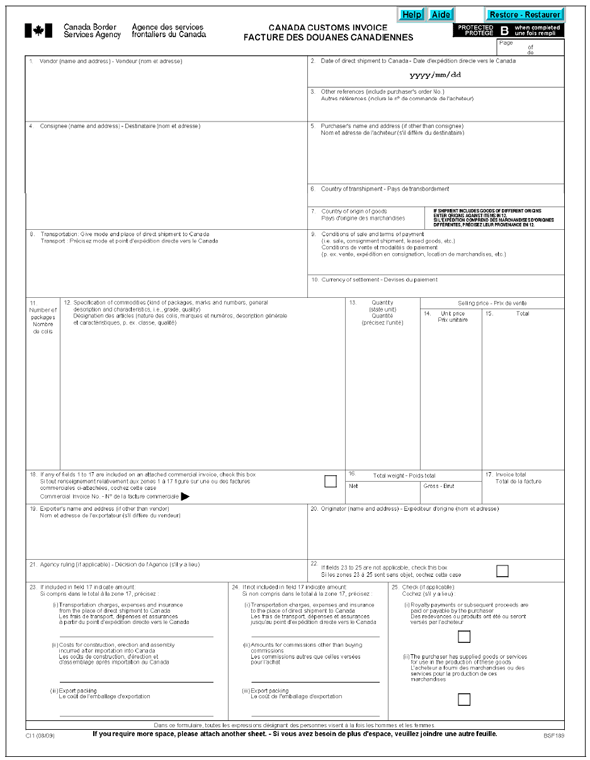

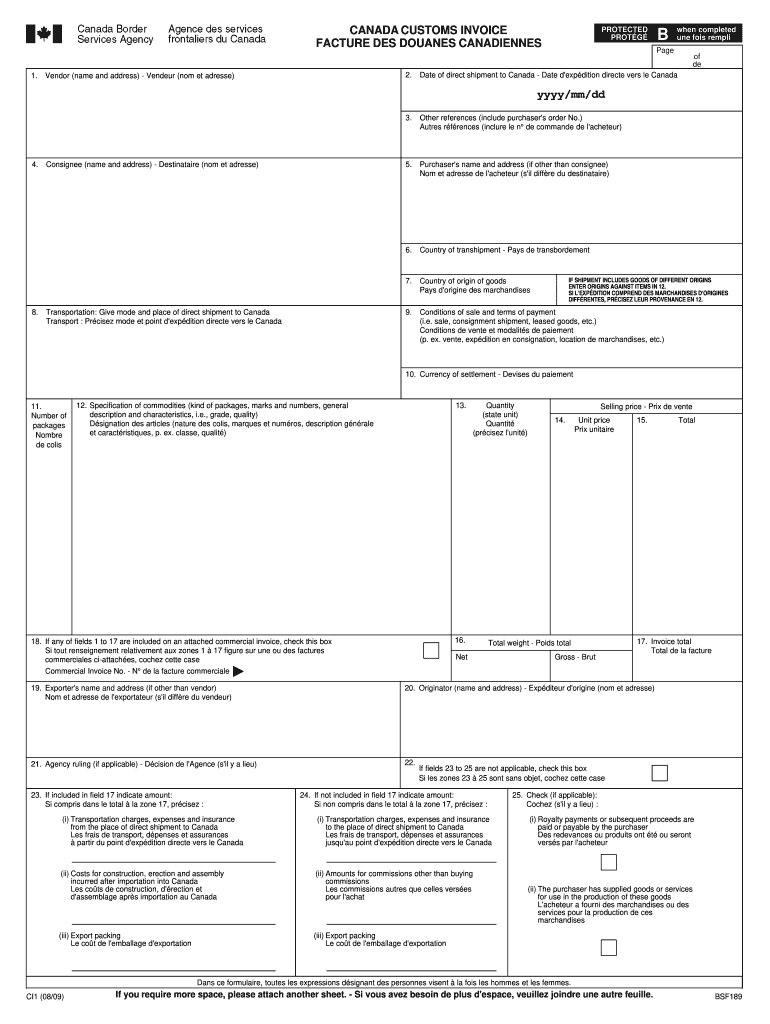

Canada Customs Invoice

When importing the CCI pays the seller for the goods. Net Gross - Brut 18.

Memorandum D1 4 1 Cbsa Invoice Requirements

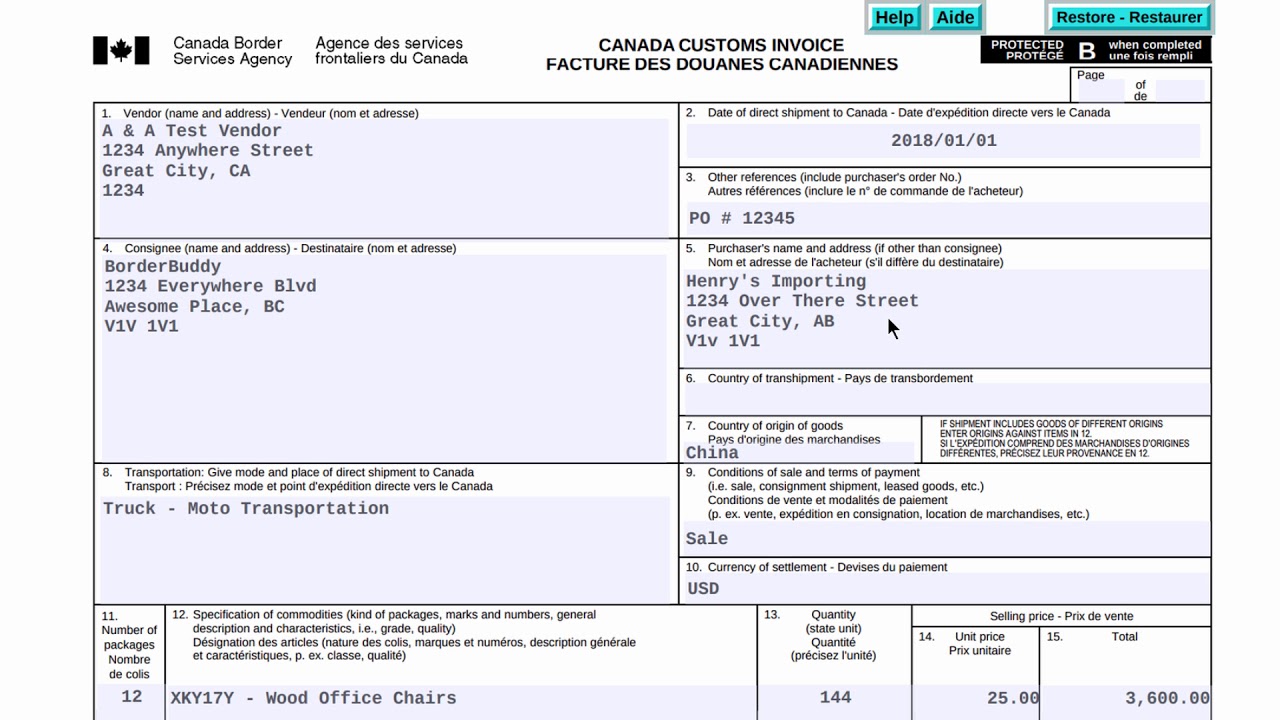

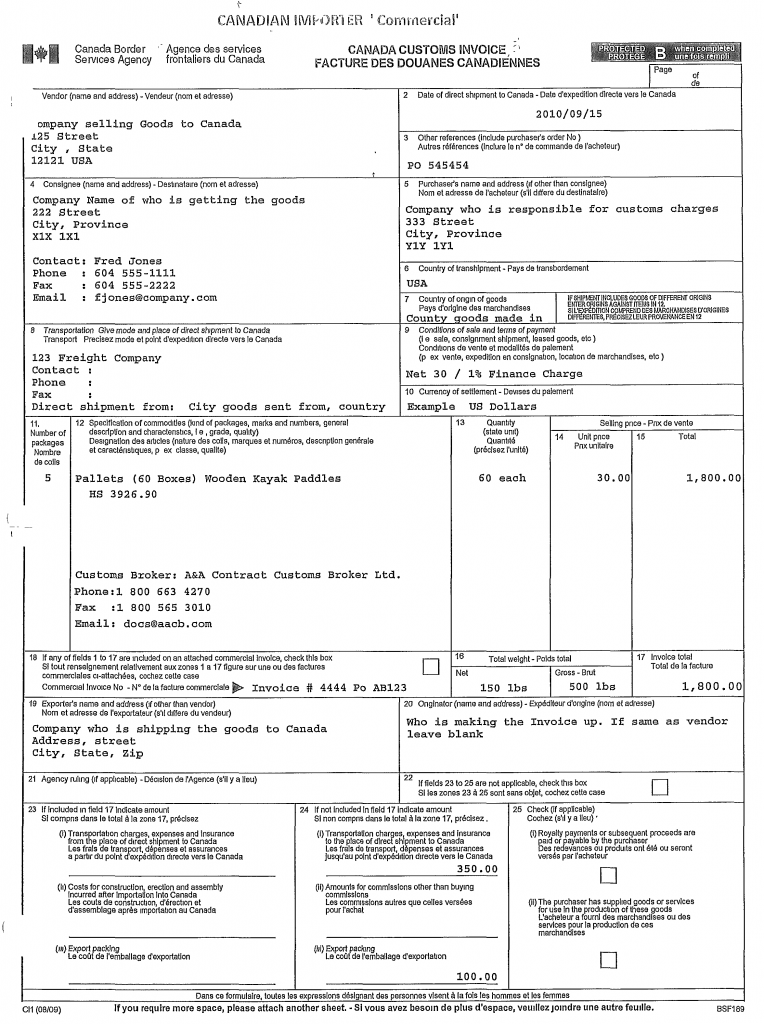

CANADA CUSTOMS INVOICE OR A COMMERCIAL INVOICE Below is a brief description of how to complete each required field on Form CI1 Canada Customs Invoice or a commercial invoice.

. A CCI is necessary for all shipments that are valued over CAD 2500 are subject to duties and sales tax or are if they are not classified under HTUSA Chapter 9810. Decide on what kind of signature to create. A Canada Customs Invoice CCI is a mandatory document for US.

A Canada invoice contains more information than a standard commercial invoice and is reviewed by the Canada Border Services Agency CBSA. Ad Download or Email Canada CI1 More Fillable Forms Register and Subscribe Now. CANADA CUSTOMS INVOICE FACTURE DES DOUANES CANADIENNES Page of de Dans ce formulaire toutes les expressions désignant des personnes visent à la fois les hommes.

Please print or type. Importing to Canada Business Numbers 2. Or b the person consigning the goods to Canada.

Canada Customs Invoices or commercial invoices containing all the CCI data are required when. Total weight - Poids total Invoice total Total de la facture 17. Identifying Restricted Non Restricted Goods 3.

Imports and exports to and from Canada. Customs invoice Canada 1. 3733 Connect E-Guides Importing Canada Customs Invoice CCI or Commercial Invoice Previous Next Importing.

There are three variants. The field name as shown on Form CI1 is in bold face with similar commercial terms in. Canada Customs Invoice CCI with calculations in Excel.

The form may be prepared by the supplier importer or customs broker. A Canada Customs Invoice CCI or Commercial Invoice is required for every commercial entry into Canada. A the person selling the goods to the purchaser.

The Canadian commercial invoice is a document required for the majority of commercial shipments entering Canada. Home Resources Canada Customs Invoice CCI with calculations in Excel. In it youll find information about the shipment vendor and consignee.

Follow the step-by-step instructions below to design your canada customs invoice pdf. Canada Customs Invoice CCI Requirements Memorandum D1-4-1 explains the customs invoice requirements for commercial goods imported into Canada. Date of Direct Shipment to Canada Date d expedition directe vers le Canada.

Create your signature and click Ok. Other References Include Purchasers Order No Autres references Inclure le n de commande de lacheteur 4. If any of fields 1 to 17 are included on an attached commercial invoice check this box.

Select the document you want to sign and click Upload. A typed drawn or uploaded signature. Indicate the name and address of.

This field may be left blank if the information is provided. Vendor Name and Address Vendeur Nom et adresse 2. Canada Customs requires certain information to be provided.

This document may be completed by the shipper or any party that has knowledge of the facts. This form is used to provide the necessary information to customs for all Canada-bound commercial goods. If the Canada Customs Invoice CCI or the Commercial Invoice CI is completed by someone other than the consignee or the vendor indicate the name and address of the completing agent.

CANADA CUSTOMS INVOICE INSTRUCTIONS Shows foreign shippers declarartion of goods destined to Canada. Canada Customs Invoice CCI or Commercial Invoice - Cross-Border Institute 519-253-3000 ext. Classifying Your Goods for Import.

The value of the goods is CA 1600 or more.

Canada Customs Invoice Requirements Youtube

Free Canada Customs Commercial Invoice Template Form Ci1 Pdf Word Excel

21 Steps To A Completed Canada Customs Invoice A A

Canada Customs Invoice Pdfsimpli

Canada Customs Invoice Coastline Express

2009 2022 Form Canada Ci1 Fill Online Printable Fillable Blank Pdffiller